Translate this page into:

Constrained backorders inventory system with varying order cost: Lead time demand uniformly distributed

*Tel.: +966 501477097 melwakeel@ksu.edu.sa (Mona F. El-Wakeel)

-

Received: ,

Accepted: ,

This article was originally published by Elsevier and was migrated to Scientific Scholar after the change of Publisher.

Peer review under responsibility of King Saud University.

Available online 5 July 2011

Abstract

This paper discusses the probabilistic backorders inventory system when the order cost unit is a function of the order quantity. Our objective is to minimize the expected annual total cost under a restriction on the expected annual holding cost when the lead time demand follows the uniform distribution. Then some special cases are deduced and an illustrative numerical example with its graphs is added.

Keywords

Probabilistic model

Inventory

Varying order cost

Holding cost

Lead-time demand

Uniform distribution

Safety stock

1 Introduction

Many authors including Feldman (1978), Richards (1975) and Sahin (1979) have studied continuous review inventory models with constant units of cost and stationary distributions of inventory level. The inventory models under continuous review with stationary distribution of inventory level, or inventory position in the case of positive lead-time, have been derived using renewal theory as in Arrow et al. (1958). In addition, Ben-Daya and Abdul (1994) examined unconstrained inventory model with constant units of cost, demand follows a normal distribution and the lead-time is one of the decision variables.

Taha (1997) treated unconstrained probabilistic inventory problems with constant units of cost. Hadley and Whitin (1963) discussed probabilistic continuous review inventory models with constant units of cost and the lead-time demand is a random variable. Their work gives heuristic approximate treatment for each of the backorders and the lost sales cases. Fabrycky and Banks (1967) studied the probabilistic single-item, single source (SISS) inventory system with zero lead-time, using the classical optimization. Abou-El-Ata et al. (2003) introduced a probabilistic multi-item inventory model with varying order cost; zero lead-time demand under two restrictions and no shortage are to be allowed. Fergany and El-Wakeel (2006a,b), applied several continuous distributions for constrained probabilistic lost sales inventory models with varying order cost using Lagrangian method. Recently, Kotb and Fergany (2011) deduced multi-item EOQ model with varying holding cost using geometric programming approach.

This paper considering the backorders inventory model with varying order cost, a restriction on the expected annual holding cost and the lead-time demand follows Uniform distribution. The policy variables of this model are the order quantity and the reorder point, which minimize the annual total cost. Finally, two special cases are deduced, which have been previously published and a numerical illustrative example is added with its graphs.

2 Assumptions and notations

The following assumptions are usually made in the simple treatments for developing the mathematical model:

-

The reorder point r is positive.

-

The demand is a random variable with known probability.

-

An order quantity of size Q per cycle is placed every time the stock level reaches a certain reorder point r.

-

Assume that the system repeats itself in the sense that the inventory position varies between r and r + Q during each cycle.

The following notations are adopted for developing our model:

ch = The holding cost per year

cb = The backorder cost per unit backordered per cycle

co = The order cost per cycle

Co(Q) = coQβ = The varying order cost per cycle, β is a real number

= The average demand per year

E(r − x) = ss = Safety stock = The expected net inventory

= The average units on hand inventory =

K = The limitation on the expected annual holding cost

L = The lead time between the placement of an order and its receipt

n = The number of cycles

N = The inventory cycle

Q = The order quantity per cycle

x = The continuous random variable represents the units demanded during L

f(x) = The probability density function of the lead-time demand x

r − x = The random variable represents the net inventory

p(x > r) = The probability of shortage =

= The reliability function

= The expected number of backorders per cycle =

3 The mathematical model

Using the expression of the expected value of a random variable, it is possible to develop the expected annual total cost as follows:

The optimal values Q∗ and r∗ can be found by setting each of the corresponding first partial derivatives of Eq. (9) equal to zero at Q = Q∗ and r = r∗ respectively, we obtain:

-

Step 1: Assume that and r = E(x), then from Eq. (10) we have:

(12) -

Step 2: Substituting from Eq. (12) into Eq. (11) we get:

(13) -

Step 3: Substituting by r1 from Eq. (13) into Eq. (10) to find Q2 as:

(14)The procedure is to varyλ in Eqs. (13) and (14) until the smallest value of λ. > 0 is found such that the constraint holds for the different values of β. -

Step 4: Repeating the steps 2 and 3 until obtaining successive values of Q and r, such that they are sufficiently close, which are the optimal values Q∗ and r∗.

4 The uniform model

To get an exact solution, assume that the lead-time demand follows the Uniform distribution, as follows:

Let

and

5 Special cases

We deduce two special cases of our model as follows:

-

Case 1:

Let β = 0 and K → ∞ ⇒ Co(Q) = co and λ = 0. Thus Eqs. (10) and (11) become: This is unconstrained probabilistic inventory model with backorders case and constant units of cost, which are the same results as in Hadley and Whitin (1963).

-

Case 2:

Let β = 0 and K → ∞ ⇒ Co(Q) = co and λ = 0, when the lead-time demand has the Uniform distribution. In this case, we obtain an exact solution of the optimal inventory policy. So Eqs. (21) and (22) will be in the form:

This is unconstrained probabilistic inventory model under backorders case with uniformly lead-time demand and constant units of cost. Which are the same results as in Fabrycky and Banks (1967) when we consider that the unit cost cP of the item is a constant independent of Q.

6 An illustrative example

Consider an item for the demand treated as a constant, the average demand being 100 units per year. The cost of placing an order is a function of Q and equal to $40.00.The item’s holding cost is $4.00 per year. The procurement lead-time is not a constant and the lead-time demand is distributed uniformly in the interval 0–20 units. All demands occurring when the system is out of stock are backordered, and the cost is $7.00 per backorder. The inventory is controlled using a 〈Q, r〉 system under the constraint that the average holding cost is either less than or equal $120 per year. Determine Q∗ and r∗ for this model.

Using Eqs. (21) and (22), we can obtain the optimal values Q∗ and r∗ for different values of β at varying values of λ that yield the holding constraint as shown in Table 1.

β

λ∗

Q∗

r∗

E(OC)

E(HC)

E(BC)

min(TC)

0

0

47.5191

14.2062

84.1767

111.143

13.1424

208.462

0.1

0.09

52.968

13.4017

112.318

119.543

14.3843

246.245

0.2

0.302

56.92

11.5303

157.706

119.961

22.0551

299.722

0.3

0.54

61.6328

9.1526

223.456

119.876

33.4099

376.742

0.4

0.789

67.405

6.2956

319.775

119.992

48.7603

488.528

0.5

1.025

74.4607

2.7677

463.55

119.992

69.791

653.333

0.6

1.246

82.1577

−1.0887

685.805

119.961

94.7305

900.496

0.7

1.414

89.2209

−4.6148

1039.73

119.983

118.84

1278.55

0.8

1.464

91.5611

−5.7836

1620.76

119.988

127.062

1867.81

0.9

1.167

79.2261

0.37909

2583.291

119.969

85.03

2788.3

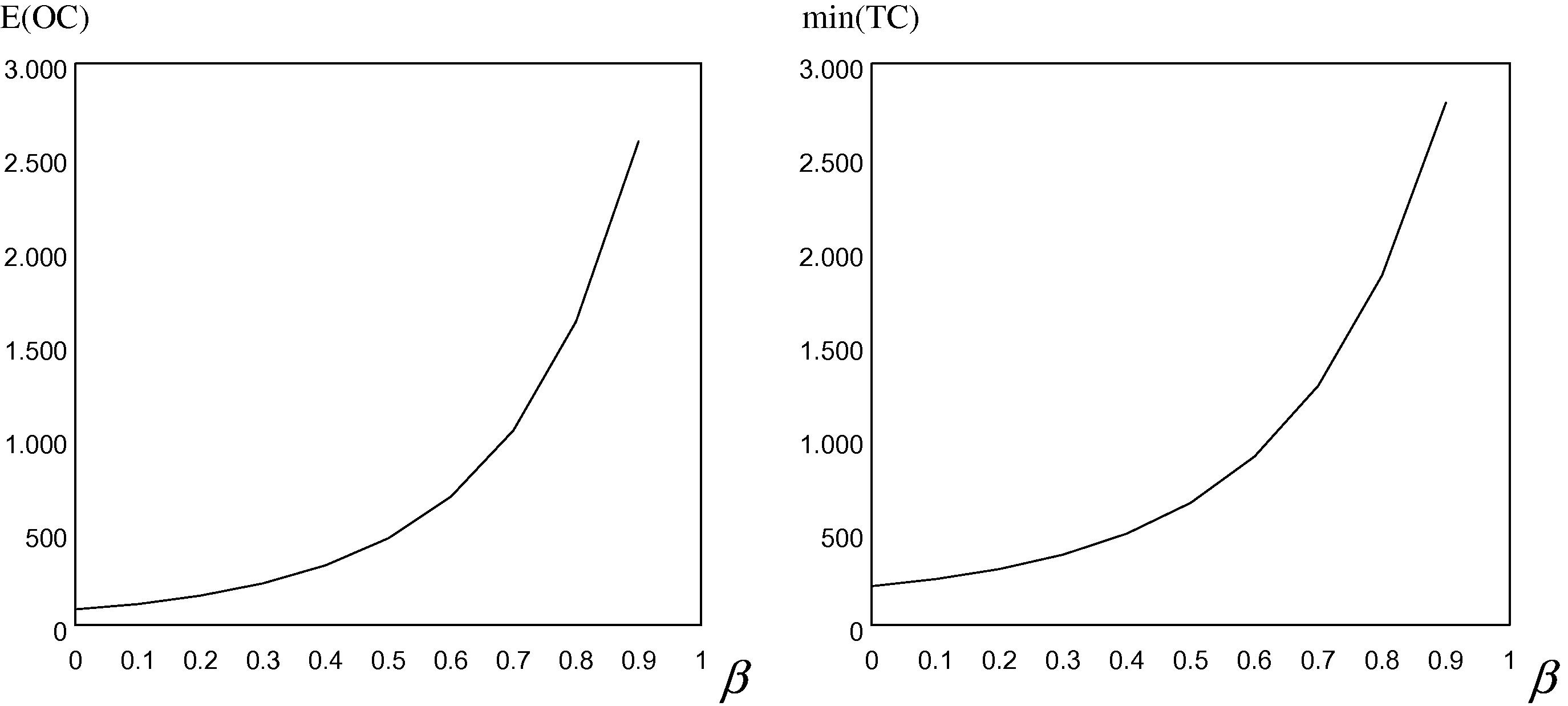

From the above table, we can draw each of E(OC) and min E(TC) against β as shown in Fig. 1.

The expected order cost and the expected total cost via the values of β.

7 Conclusion

This paper investigating probabilistic backorder inventory system with varying order cost and continuous lead time demand under the holding cost restriction. We have calculated Q∗ and r∗ numerically and obtain the min (TC) for different values of β by using Lagranian multiplier technique. In the Uniform model, we can evaluate the exact solution for each Q∗ and r∗ at different values of β, which minimize the expected total cost, mathematically.

References

- Probabilistic multi-item inventory model with varying order cost under two restrictions: a geometric programming approach. Int. J. Product. Econ.. 2003;83:223-231.

- [Google Scholar]

- Studies in Mathematical Theory of Inventory and Production. Stanford, CA: Stanford University press; 1958.

- Inventory models involving lead-time as a decision variable. J. Oper. Res. Soc.. 1994;45(5):579-582.

- [Google Scholar]

- Procurement and Inventory System: Theory and Analysis. USA: Reinhold Publishing Corporation; 1967.

- A continuous review (s, S) inventory system in a random environment. J. Appl. Prob.. 1978;15:654-659.

- [Google Scholar]

- Constrained probabilistic lost sales inventory system with normal distribution and varying order cost. Sci. Publ., Am. J. Math. Stat.. 2006;2(1):363-366.

- [Google Scholar]

- Constrained probabilistic lost sales inventory system with continuous distributions and varying order cost. J. Assoc. Adv. Model. Simul. Techniq. Enterpr.. 2006;27(N 3-4)

- [Google Scholar]

- Analysis of Inventory Systems. Englewood Cliffs, NJ: Prentice Hall; 1963.

- Multi-item EOQ model with varying holding cost: a geometric programming approach. Int. Math. Forum. 2011;6

- [Google Scholar]

- Comments on the distribution of inventory position in a continuous review (s, S) inventory system. Oper. Res.. 1975;23:366-371.

- [Google Scholar]

- On the stationary analysis of continuous review (s, S) inventory systems and constant lead-times. Oper. Res.. 1979;27:717-729.

- [Google Scholar]

- Operations Research (6th ed.). Englewood Cliffs, NJ: Prentice Hall; 1997.